Final Salary Transfer Values – the end is nigh

Final Salary Transfer Values – the end is nigh

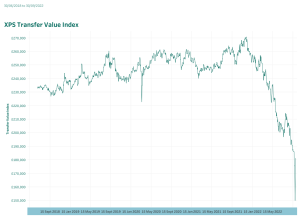

We’ve had a golden decade of unusually high Defined Benefit pension transfer values. Cash Equivalent Transfer values or ‘CETVS’ reached an all time high in December 2021. XPS tracked that a 64 year old with a £10,000 annual, indexed scheme pension would have been offered around £270,000 to transfer the benefits back in December last year. By 24th September 22, this had dropped by a staggering £120,000 or 44%!!

To explain why this has happened, I need to firstly explain how these transfer values are calculated….

A Defined Benefit pension, more commonly known as a ‘Final Salary’ pension is like gold dust these days. Where it was once a standard practice to enter employment and join a FS scheme, they are now a dying breed. In lay man’s terms, the employer and scheme carry all of the investment risk throughout your journey, and guarantee you a set amount of income at retirement. This amount is based on your length of service, salary when leaving, and the scheme’s bespoke accrual rate. These schemes are costly and a hindrance for the employer. Nowadays, most DB schemes are closed to new employees and are only open for public sector workers. The costs of guaranteeing someone a set amount of income at a future date, without knowledge of future markets, is burdensome and has taken thousands of schemes under.

Defined Benefit schemes legally have to offer a CETV once a year. This is a changing figure than can allow the scheme member to forfeit all of the guarantees that are offered to them, and transfer out to a pension of their choosing (personal pension, SIPP, Drawdown, annuity etc). There can be different reasons for wanting to do this and it is bespoke for each client.

So how does the scheme put a transfer value together and why does it change if it is based on a guaranteed benefit?

Working out a CETV is a complex process involving many factors. As well as considering how much has been paid into the scheme, it’s also based on some personal and social factors. These include:

- Your age and your scheme’s retirement age

- Life expectancy

- The cost of living

- Your relationship status

- The pension transfer value index

- How much your provider wants to encourage you to transfer out

CETVs can rise or fall depending on all of these factors, and those that have made the biggest impact recently are points 3 and 5.

Transfer values can be loosely correlated to interest rates; as the calculation includes gilt yields and annuity rates which are positively correlated to interest rates, if we have higher yields then we need less money to buy the guarantee! Let’s put this into context using the example in the first paragraph:-

In 2021, John has an entitlement to £10,000 pa from his DB pension. The scheme have calculated that he needs £270,000 to roughly purchase an equivalent amount on the open market (not a direct science as the scheme pension is always higher but I will carry on to simplify things!) Taking everything else out of the equation, let’s assume this is because the annuity for a 64yr old, with RPI rises are 3.7% at the time of calculation.

However in September 2022, annuity rates may now be 5.5% for the same annual income; we now need less money to purchase the same income! The CETV has now dropped to £183,000( 5.5% of this is £10,000.

2021: Annuity rate is 3.7%: £10,000pa = £270,000 x 3.7%

2022: Annuity rate is 5.5% :£10,000 pa =£180,000 x 5.5%

Whilst Gilt yields may settle over the coming months/year and may drop as we (hopefully) achieve more financial stability in the country, due to higher interest rates and austerity measures for the next few years, it is extremely unlikely that will see transfer values ever reach their 2021 for the next decade or so

Frances Giliker

Chartered Financial Adviser and Pension specialist

If you would like a no obligation meeting with Frances regarding your workplace pension, please contact us on 01782 840590 or via the enquiry page. We are a Staffordshire, Stoke on Trent and Newcastle under Lyme based Independent Financial Advisor who specialise in pensions, retirement planning and investments. Get in touch with our advisers today, so we can make tomorrow happen!